Project overview

Key drivers of this initiative include; the Vision 2030 goal to encourage Saudis to save, digital challenger defence, positioning the bank to be Open Banking ready and YOY growth in cash balances ambition.

Gravitas was engaged to define the PFM strategy across the banks business units and digital channels as well as designing the PFM experience in mobile and desktop banking.

The problem statement

In a culture where saving is not the norm, how do we ensure strong customer adoption of a new saving concept.

The Symptom

Saudis are traditionally a borrowing culture not a saving culture, apparent in most customer’s maximising their DBR. Furthermore, PFM is a new to market concept.

The Impact

Cash deposits are below expectations, mortgage sales are limited by SAB customers ability to provide a cash deposit. Wealth products sales are also affected by this issue.

The Scope

Define the product strategy, define cross bank initiatives required to support PFM. Support marketing and PR teams on communication.

Work with the solution provider (Meniga) to integrate key functionality and develop roadmap.

The Ask

Define the PFM strategy across the banks business units and digital channels as well as designing the PFM experience for mobile and desktop banking.

Challenge 1: Transactional Data Enrichment.

How might we enrich transactional data to offer deeper, actionable insights that guide smarter spending and saving?

Reality

Available transaction data needed to be “cleaned” and standardised to ensure consistency display, while also implementing features that capture the necessary and relevant information for enhanced financial insights.

Desired Outcomes

- Actionable transaction data.

- Increased user engagement.

- Proactive budgeting.

- Improved retention rates.

- Improved financial literacy.

Solution

Categorising transactions, adding merchant details, and standardising data for consistency.

Providing clear, actionable insights into their financial behaviour, such as monthly trends, spending alerts and tailored recommendations.

What we did…

-

- Data Standardisation

Challenge 2: Integration.

How might we integrate the mobile app with the PFM solution provider for a cohesive, user-friendly experience?

Reality

The solution provider faced challenges in executing the vision we had. Some of their capabilities were limited, meaning we had to push through those boundaries to ensure the product met our high standards and the ambitious goals of the project.

Desired Outcomes

- Output aligned to intended design.

- Real-Time data synchronisation.

- Improved security ensuring compliance with industry standards.

- Scalable architecture.

Solution

Clarifying technical requirements and data flows. Addressing potential roadblocks, such as compatibility issues, and discussing solutions in real-time.

Facilitating continuous feedback loops to ensure the final product met both functional and user experience goals.

What we did…

- Program Management

- Integrate project plans

- Combined Agile Rituals

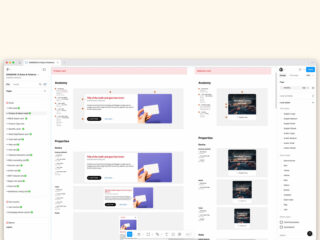

- Design System

- DevOps

- Co-creation Workshops

Challenge 3: Navigating market leadership.

How might we innovate and set new benchmarks for PFM solutions in the region?

Reality

Being the first in the region to offer such an exhaustive PFM solution, the existing features did not fully leverage modern user expectations and technological advancements.

This gap required a rethinking of the approach to user engagement and design.

Desired Outcomes

- Pioneer in the regional market for innovative PFM solutions.

- Data driven insights.

- Robust adoption rates.

- Improved financial wellness.

- Increase cash deposits.

- Increase wealth product sales.

Solution

Implementing a phased rollout plan to gather feedback and iteratively improve the product.

This approach played a pivotal role in strengthening its market leadership based on real-world use and feedback.

What we did…

- Competitor Analysis.

- Global Best practices.

- Feature Prioritisation Workshops.

- Rollout Plan.

Challenge 4: Design alignment.

How might we design a new identity for PFM while integrating it with the existing HSBC / SAB visual language?

Reality

The existing design system was traditional requiring careful consideration to maintain its integrity, yet enhance its appeal. We had to find the balance between making the design vibrant and intuitive for user adoption without compromising the brand’s established identity.

Desired Outcomes

- A refreshed and modern feel, not too far from the original style.

- Increased user adoption.

- A design system that is scalable for future enhancements.

- Simplify complex financial data.

Solution

We developed a structured process to harmonize the old design system with the proposed fresh look. This involved application of design best practices, research, concept development and iteration.

What we did…

- Component Mapping.

- Design direction.

- Design system.

- Library maintenance.

- Complete UX revamp.

- User Interface Design.

- Documentation.

- Quality check.

- Dev Handover.

Results

Saudi’s first bank integrated PFM solution, 80% customer adoption, increase in cash deposits and wealth products sales.

#1

The first PFM solution by a bank in Saudi Arabia.

~80%

Customer adoption and uptake of PFM as a service.

5%

Increase in cash deposits by existing customers.

4.5%

Sales uplift across Wealth Management.