Project overview

A bank in Saudi Arabia was facing immense pressure from both internally and from the Central bank(SAMA) due to customer accounts being frozen as a result of its KYC process.

A leading Strategy House (McKinsey) tried and failed to solve the problem. Based on our proven expertise in fast-tracking complex problem solving, Gravitas was asked to step in and accelerate from issue to resolution.

The problem statement

The bank’s KYC process was fragmented and inefficient, leading to a high volume of account freezes, delayed processing, and poor customer experience.

The Symptom

Over ~500K banks accounts were being frozen annually resulting in a significant loss of customers and revenue.

The Impact

This resulted in an; increase in branch footfall & call centre load, customers closing their accounts, complaints to the central bank and escalations to the board & senior executives.

The Scope

Encompassed KYC process, KYC governance, internal systems, operations & compliance, branch staff, digital channels and regulatory eServices.

The Ask

Fix it and reduce the account freeze event back 3% (relative to regulatory flags and non compliant customers).

Challenge 1: High Volume of Account Freezes.

How might we reduce the number of account freezes by proactively addressing KYC expiry & simplifying the renewal process?

Reality

The customer KYC process was not documented, understood, updated, nor communicated.

Desired Outcomes

- Defined KYC process bank wide.

- Documented, accessible and communicated of existing KYC workflows.

- Identify the gaps, inefficiencies and opportunities to streamline the KYC process.

Solution

A single source of truth was created with the collaboration of the internal stakeholders that represented the current state, end-to-end process off the customer KYC lifecycle.

This included a complete catalogue of 23 processes across 7 KYC categories.

What we did…

- Problem definition.

- Co-creation workshops.

- Ideation workshops.

- Process mapping.

- Research & benchmarking.

- Report of finding with recommendations.

Challenge 2: Manual & Time-Consuming KYC Update Process.

How might we automate and digitise the KYC update process to enable faster, more efficient updates and reduce manual intervention?

Reality

The KYC update process was heavily manual, requiring significant time and effort from both customers and bank staff, leading to slow processing and delays in account reactivation.

Desired Outcomes

- Enable eKYC for 97% of customers.

- Reduce TAT for KYC updates that require manual intervention.

- Increase internal operational efficiency.

- Improved accuracy and reduced errors in KYC processing.

Solution

An eKYC solution that plugs into the banks existing digital channels and enable 97% of customers to carry out STP (instant) KYC updates without the need to visit a branch.

This also included non-resident customers who do not reside in KSA.

What we did…

- Current state analysis.

- Digital Review.

- Benchmarking & Industry best-practice research.

- Fintech scouting.

- Ideation workshops.

- North star definition.

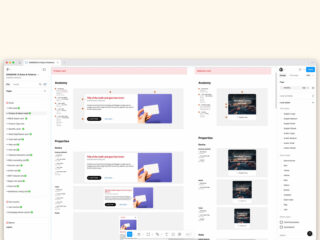

- User Experience Design.

- User Interface Design.

- Prototyping.

- Backlog & program development.

Challenge 3: Limited Cross-Department Collaboration.

How might we foster cross-departmental collaboration and ensure alignment in KYC handling to streamline operations and enhance service delivery?

Reality

There was a lack of collaboration and information sharing between departments, resulting in inconsistent handling of KYC issues and inefficient internal operations.

Desired Outcomes

- Cross-department visibility & accountability.

- Consistent handling of KYC updates and account freezes.

- Establish real-time KYC analytics & insights.

- Governance model.

Solution

We identified early in our discovery that the current problem is a symptom of the cause: the KYC carried out during the customer on-boarding with the Bank.

As there was no owner of the KYC process, we worked with the internal stakeholders to identify a governance model that would enable the bank to put momentum behind KYC related initiatives.

What we did…

- Stakeholder interviews.

- Co-creation workshops.

- User journey mapping.

- Report of findings.

- Governance model.

Challenge 4: Lack of Personalised, Relevant & Timely Communication.

How might we enhance communication strategies to deliver timely, personalised, and clear updates to customers about their account status and KYC requirements?

Reality

The bank’s communication with customers regarding account freezes was ineffective and poorly executed, failing to provide clear, actionable information tailored to individual customer needs.

Desired Outcomes

- Communication strategy based on customer KYC segmentation.

- Communication strategy based on channel.

- Improved customer knowledge and experience of KYC updates.

- Reduce number of customers who do not take action.

Solution

Based on the 27 KYC policies, we created a comprehensive pre-and-post freeze communication strategy that included customer segmentation, messaging, channel’s, frequency, urgency and actions that need to be taken, gravitating from the KYC expiry date of each banking customer.

What we did…

- Communication strategy.

- Channel strategy.

- Customer segmentation (by KYC policy).

Results

We did what Mckinsey couldn’t do….

Happy customers, happy Board, more productive employees.

One

Single source of truth was developed to provide complete transparency and accountability of the banking KYC policies, agreed by all relevant departments and stakeholders.

97%

of customers can immediately complete their KYC process (STP), avoiding account freezing and unnecessary branch visits.

48

High-Impact Low-Effort Quick Wins were identified that put immediate relief on the operational team and branches.

66

New initiatives and projects were identified across the customer lifecycle management to further digitise and automate the KYC process, prioritised into 1 master program, currently in implementation.