Project overview

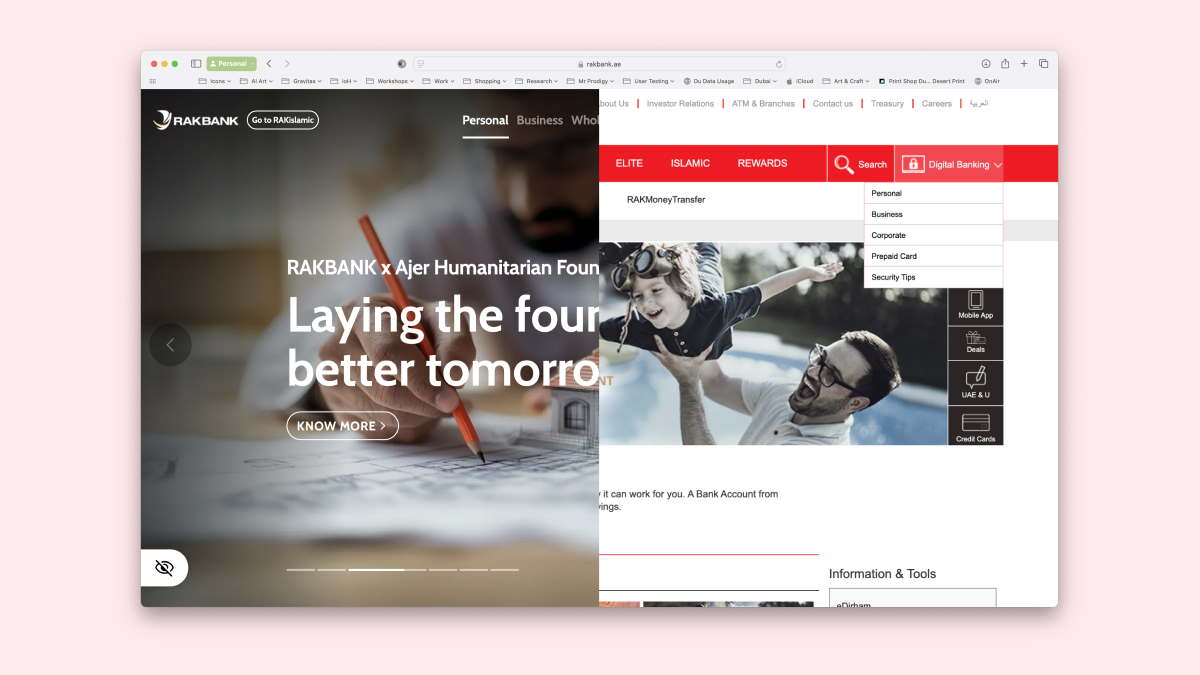

RAKBANK, one of the UAE’s leading financial institutions, partnered with Gravitas to redesign and re-platform their website.

The goal was to update the brand’s digital identity to reflect its values of innovation, boldness, and customer-centricity, positioning RAKBANK as a leader in digital banking in the UAE.

The problem statement

RAKBANK’s website and current legacy technology limits the ability of the organisation to maximise digital conversion and customer engagement.

The Symptom

A website that looked like it was designed in the early 2000’s, poor information architecture, challenging user experience and a different brand, offline vs online

The Impact

Low, conversion rates, 90% bounce rates, 1000+ redundant pages of content, low SEO ranking, no digital assets management, no personalisation, legacy content management capabilities, limited financial tools, two weeks to publish a page on production, low productivity from the digital team, frustrated stakeholders.

The Scope

Website development with DXP, connection with the assets DAM, SEO, Analytics, DesignOps connected to Storybook and solution architecture, API integration, interactive tools, CPF compliance.

Ensure that all of the covers both conventional and Islamic banking.

The Ask

Redesign and re platform the website to Optimizely, deploying experimentation and the CMP.

Migrate 2000+ pages but rewrite website copy and optimize for SEO. Integrate ±100 API’s. Design and develop ±25 plus interactive calculators , Ensure CPF compliant and deploy on the Azure cloud as well as enhance lead capture and conversion rates.

Challenge 1: Migration from HCL to Optimizely using REACT.

How might we ensure a seamless migration to Optimizely using a REACT-based framework to deliver a fast and responsive user experience?

Reality

RAKBANK’s legacy CMS was limiting the bank’s ability to deliver a best in class experience and create value for the bank through conversion.

Desired Outcomes

- Best in class digital marketing toolkit.

- Faster to market.

- Increased digital marketing productivity.

- CPF compliance.

- Scalable architecture.

Solution

Optimizely – a leading Gartner Magic quadrant Digital Experience Platform.

Content everywhere – a headless approach to ensure seamless distribution of content across channels.

Asset efficiency – development of react components in storybook to reuse across desktop banking.

Scalable architecture – a future ready web, cloud and application design.

What we did…

- A design system to unify brand elements & reduce design debt.

- Content migration plan aligned to compliance, a new tone of voice & copy.

- Optimizely SaaS services with headless CMS integration, for fast, content delivery.

- 100+ APIs integration.

- A/B testing, personalisation, and analytics tools to continuously improve user experience and optimise conversion funnels.

- Global delivery across three continents.

Challenge 2: Ensuring Compliance with UAE Central Bank CPF Rules.

How might we ensure that all product information is fully compliant with the UAE Central Bank Consumer Protection Framework (CPF) rules?

Reality

The UAE Central Bank’s Consumer Protection Framework (CPF) mandates transparency and visibility of all financial products. The bank needed a digital platform that ensured all product data — especially loans, credit cards, and mortgages — was clearly visible and compliant with regulatory standards.

Desired Outcomes

- Full compliance with UAE Central Bank CPF rules, ensuring transparent product data display.

- Enhanced product visibility and clear communication of terms for all financial services.

- Ensure all key product information was easily accessible across various digital touch-points.

Solution

Gravitas worked to integrate clear and compliant product data across the website, ensuring alignment with CPF rules.

A structured content framework was developed for all product pages, providing users with transparent information while maintaining an intuitive user experience.

What we did…

- Collaborated with RAKBANK’s compliance and product teams to ensure all information on finance products were up-to-date and in line with CPF guidelines.

- Implemented dynamic content modules and calculators that ensured product details were clear, visible, and easy to navigate for users.

- Built mechanisms to monitor and update product information regularly to maintain compliance.

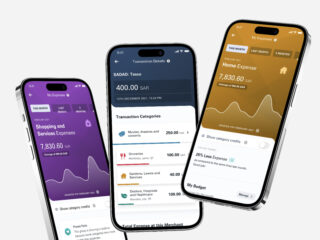

Challenge 3: Enhancing User Experience & Personalisation for Gen Z & Millennials.

How might we design a personalised, intuitive digital experience for Generation Z and Millennials that keeps them engaged, improves conversions, and delivers a seamless user journey, tailored to their preferences and behaviours?

Reality

RAKBANK’s previous website was not optimised for the digital-first mindset of Generation Z and Millennials.

These tech-savvy users expected personalised, intuitive digital experiences that catered to their unique needs and preferences, while the old website struggled with engagement and conversion.

Desired Outcomes

- Improve engagement and conversion rates among younger, digital-native customers.

- Implement personalised experiences based on user behaviour and preferences.

- Provide a seamless user journey with clear calls-to-action and conversion paths.

Solution

Gravitas designed and implemented a new website that was fully optimised for personalisation.

Leveraging Optimizely content delivery API, we created tailored experiences for different user segments.

We also optimised the site for A/B testing, allowing RAKBANK to deliver unique content and experiences to users based on their interactions.

What we did…

- Created user personas for key segments to guide the design and functionality of the site.

- Integrated Optimizely personalisation features to dynamically adjust content, product recommendations, and calls-to-action based on user behaviour.

- Optimized the site’s content and conversion funnels, focusing on key touchpoints for product applications.

Results

Award winning website that is fully CPF compliant.

The project set a new standard for digital banking experiences, positioning RAKBANK as a leader in engaging younger, digital-first audiences while maintaining regulatory compliance and elevating operational efficiency.

#1

Website of the year – 20th Asian Banking & Finance Awards (UAE).

100%

The website met all UAE Central Bank CPF compliance standards, ensuring full transparency and visibility of financial product data.

3.5%

Personalisation drove the conversion rate, up from .05% on digital marketing campaigns to 3.5%. for key product campaigns like credit cards and personal loans.

200%

The website’s flexible architecture allowed RAKBANK to launch new products and updates 200% faster than before.